Old design of Remote Tax Expert

District Managers Interview Affinity Mapping

Franchise Owners Interview Affinity Mapping

Service Blueprint of the Client and Tax Pro Journey.

UX Audit of RTE Dashboard (Delta)

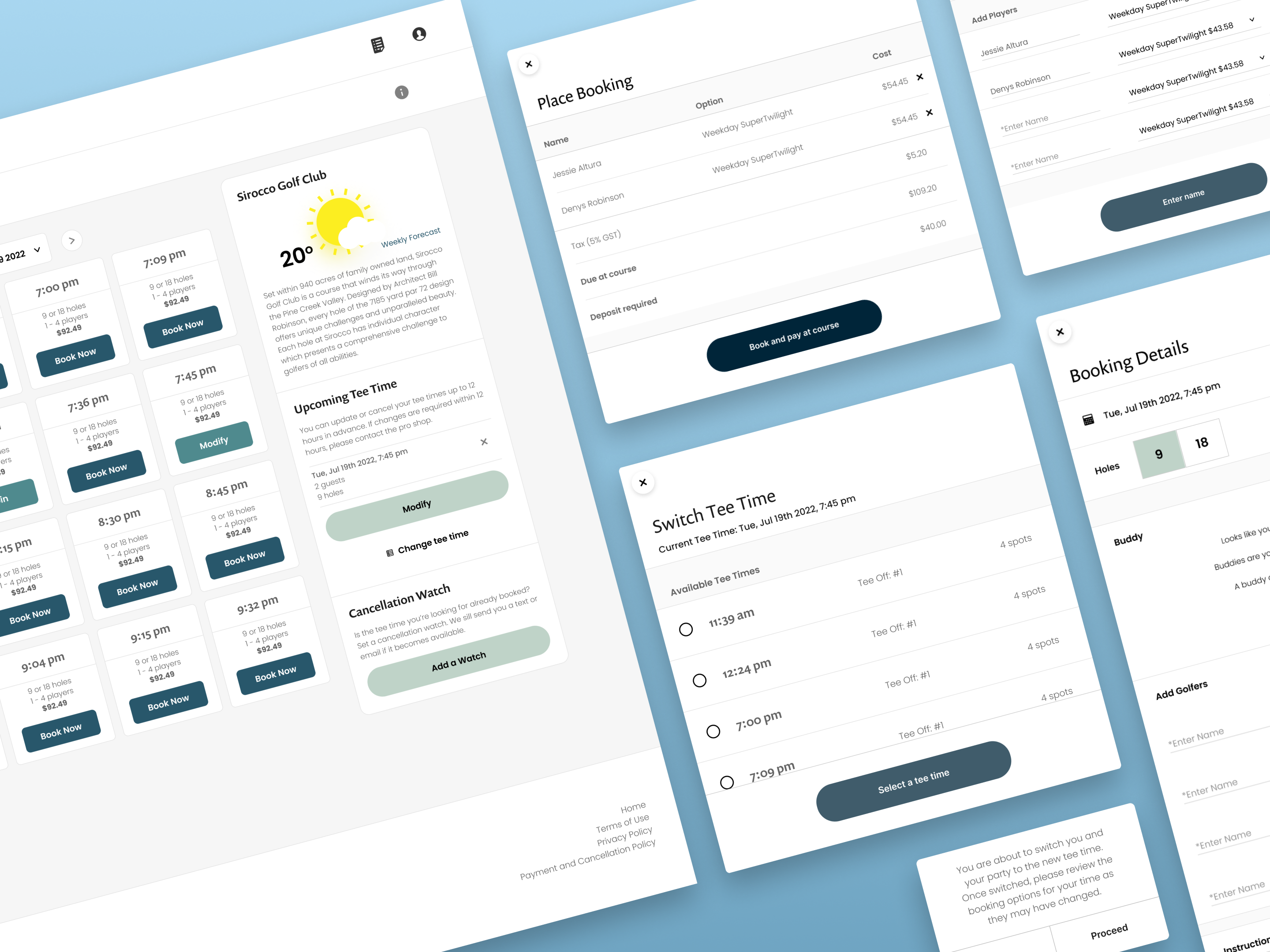

The design deliverable for RTE, showing the user flow of the new Dashboard screen.

User Flow of the proposed new ticket management system in Client Spark

User Flow for the Bypass Authorization flow

Remote Tax Expert Design Systems: Typography, Radio Group, Checkbox, and Dialog Box

Prototype setup for the new RTE Authorization functionality. I used Figma's variables to set up a more simplified prototype.

Remote Tax Expert's new Dashboard design. Key upgrades include the progress bar, tax years separated by tabs, and a cleaner design for more efficient scanning.

The updated authorization functionality in RTE is designed to accommodate the new CRA policy changes regarding how tax preparers represent their clients.

Client Spark, the application used by H&R Block associates, showcases the new ticket management functionality that enables tax pros to control their tickets.

Conversion Funnel rate for Remote Tax Expert